Phusjon Group

Integrated Advisory Services for Business Owners

Phusjon Group

Integrated Advisory Services for Business Owners

Phusjon Group

One of the significant trends in the Asia Pacific region over the last few decades has been the emergence in a number of countries of new or tightened laws on privacy of personal data or “Data Privacy”.

This trend has created a particular challenge for forensic practitioners providing integrity due diligence services to clients seeking to mitigate their risk(s) before deciding on significant investments in the region. Not only does a forensic practitioner need to understand where and how to obtain relevant background information on a target company, and key individuals associated with the target, but is also required to have a sound knowledge of all data privacy laws and guidance in the jurisdictions relevant to particular due diligence projects.

This article examines the current position regarding the Hong Kong Personal Data (Privacy) Ordinance and the Office of the Privacy Commissioner for Personal Data (HK) "Guidance on Use of Personal Data Obtained from the Public Domain" issued in accordance with the requirements of the Ordinance. The HK Special Administrative Region (SAR) has enacted a strict Ordinance to protect personal data. It specifically applies to data obtained from the public domain which practitioners previously assumed was able to be used without restriction as such information had already been disclosed to the public.

This assumption has now been legislatively overturned and the ordinance contains significant restrictions on Personal Data use, even where it is either disclosed publicly or available to the public to access relatively easily. The Guidance specifically states the limitation on wide use of personal data in the public domain:

“It is a misconception that publicly accessible personal data can be further used or disclosed for any purpose whatsoever without regulation. The protection afforded by the Ordinance does apply to such personal data and there is no general exemption from compliance with the requirements under the Ordinance.”

From a criminological perspective, the three elements of Donald R. Cressey's fraud triangle that describe the prerequisites for fraud and corruption, i.e. pressure, opportunity and rationalization, are all present and so, in this perfect storm, bribery is the norm rather than the exception.

Efforts by corporations to reduce fraud and corruption risks are constrained by ever increasing compliance costs and by pressure to meet sales targets in an extremely competitive market. Most local Chinese pharmaceutical firms do not need to comply with the FCPA, nor the UK Bribery Act, and the chances of getting caught by Chinese economic crime enforcement officers, whilst increasing, are still very small.

By way of example, sales managers of Chinese healthcare industry companies usually receive a 1-3% commission on the sale of a drug, medical device or consumable, which is perfectly acceptable provided that the transaction is accurately recorded in the accounting books and records. However, the same sales manager will be expected to pay a 2-5% kickback to a doctor or hospital in order to secure a sale, which is not acceptable. It is unequivocally illegal by Chinese law.

Many sales and leases of medical equipment in the healthcare industry in China, even by large MNCs, do not have written contracts detailing the terms and conditions, or if they do it is not uncommon for contracts to be altered or forged. These often relate to the sale of healthcare products that have not happened or are materially inaccurate. Free consumables, which may be packaged up in the sale of an expensive medical device, may not reach the customer at all, and instead will be sold in the black market. These fictitious and fraudulent sales not only allow employees to embezzle cash, but help to fund bribery schemes.

Another common fraud is for the sales team of, say, Company A (or through a tendering agent) to prepare tender bidding documents for their own company and at the same time prepare the documents for so called "competing" Companies B and C using respective letterheads, seals and chops that are shared between the conspirators. The bids will all be more expensive than they should be, with Company A, coming in lowest, thus winning the contract as previously intended by all the conspirators. The sales teams of the various companies will take it in turns to win contracts and collectively engage in nefarious methods to place pressure on other companies outside their cartel, to either join their cartel, or be excluded from tendering fairly, either by using corrupt government connections, collusion with employees in the purchasing company or tendering agency, or by exploiting bureaucratic red tape, of which there is plenty in China.

Author: Richard Batten LL.B (Hons), Barrister and Solicitor of the Supreme Court of Victoria and Director of Censere Group Co., Ltd

Richard is a Director with the Censere Group and for the past 20 years has been assisting clients in the Asia Pacific Region with Due Diligence investigations in a variety of Mergers and Acquisitions across different industries. His projects have included clients from China, Japan, India, Korea, Australia and the USA.

One of the significant trends in the Asia Pacific region over the last few decades has been the emergence in a number of countries of new or tightened laws on privacy of personal data or “Data Privacy”. This trend has created a particular challenge for forensic practitioners providing integrity due diligence services to clients seeking to mitigate their risk(s) before deciding on significant investments in the region. Not only does a forensic practitioner need to understand where and how to obtain relevant background information on a target company, and key individuals associated with the target, but is also required to have a sound knowledge of all data privacy laws and guidance in the jurisdictions relevant to particular due diligence projects.

On basis of company sizes, market players in the Chinese dairy market can be categorized into 3 tiers. The 1st tier refers to the national players, namely, Mengniu, Yili, and Bright Dairy. The 2nd tier includes regional players, such as Beijing Sanyuan Dairy, Royal Dairy, and Yantang Dairy. The 3rd tier players focus almost solely on local markets and pose no immediate threat to players in the first two tiers. There are more than 1,500 dairy companies in China, while the number of companies with operational revenues above RMB5 million is more than 400. In 2012 the dairy industry reported sales revenue of RMB246.54 billion, the top 4 dairy companies were all domestic companies and merely accounted for around 39% of market share. Foreign dairy companies, such as Danone, Mead Johnson, and Nestle, made up more than half of the market.

With China’s expanding personal income and the growing medical needs of its aging population, its pharmaceutical market has become the second largest in the world. IMS Health predicts that global spending on medicines will reach around USD1,300 billion by 2018, a 30% increase over the 2013 level. During 2014-18, the compound annual growth rate (CAGR) on medicines spending will be 4% to 7%. China had a spending level of USD77.2 billion in 2012, which accounted for 8% of global medicines spending. It is forecasted that China’s spending level will reach USD155-185 billion in 2018, which would be the highest among emerging pharmaceutical markets. The key drivers for growth will be healthcare infrastructure improvements, increased access to medicines, and increases in the number of private hospitals.

Middle market companies with over 169 million employees and $16.6 trillion in sales contribute $11.5 trillion to the world GDP. This was indicated in a recent HSBC report, Hidden Impact: The Vital Role of Mid-Market Enterprises.

The report shows also U.S. with 55,700 middle market companies has the largest number of middle market firms among other countries. The core U.S. middle market companies with annual sales between $50 million to $500 million contribute $1.7 trillion to the U.S. economy and their 16.5 million employees are generating 13 percent of US output. That makes U.S. an economy with the most middle market companies on a global comparison.1

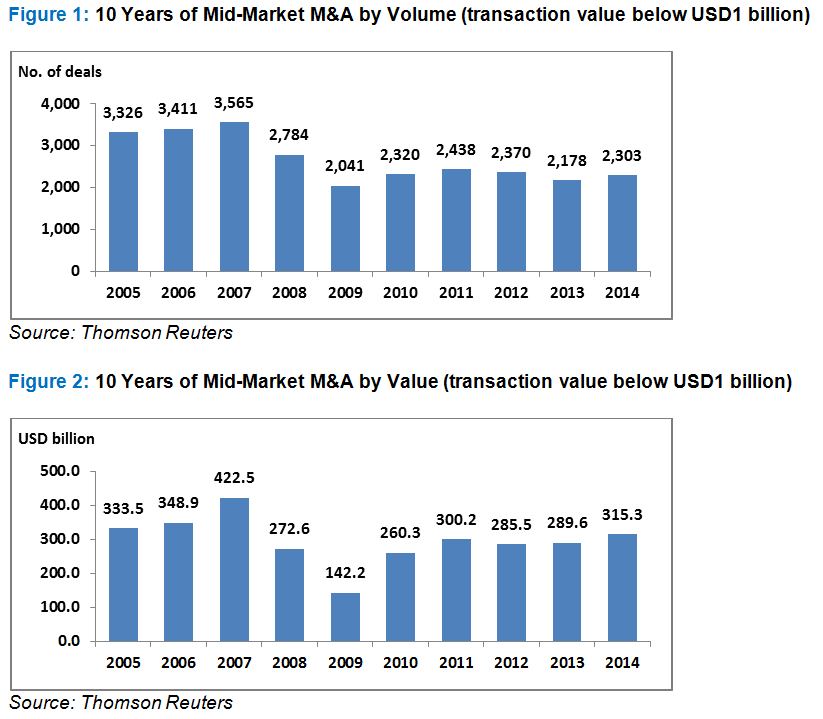

According to Thomson Reuters, the number of mid-market M&A deals (transaction value below USD1 billion) decreased from 3,326 in 2005 to 2,041 in 2009. (Figure 1) The number of deals then bounced back slightly since 2010; however, the number is still much lower than the pre-2009 level. Total transaction value between 2005 and 2014 also shows the similar trend (Figure 2).

In 2014, there were 2,303 mid-market transactions completed in the US market, amounted to USD315.3 billion. Several factors accounted for another good year for transactions including increasing confidence in the well-being of the economy, massive cash on corporate balance sheets, highly liquid securities in private equity funds, all-time low interest rates and well performing equities markets. (Figure 2). Commercial real estate, oil and gas, software, banks and professional services were the five most active middle market sub-sectors in terms of transaction volume.2

Financial stress is widely recognized as one of the key reasons why people commit fraud. Some people commit fraud for other, pathological, reasons, but these are small in number and not typically the kind of fraudsters we deal with daily.

However employees and suppliers who have had a long and trusted relationship with you may feel added pressures when there are dark clouds on the horizon. Presently with the price of oil, coal and other minerals at recent record low, many Resources and Energy Sector employers are looking to reduce costs to help mitigate any potential losses. Orders are down, inventories are being reduced, payment cycles are increasing; there is generally a greater level of uncertainty right now.

Your staff and suppliers may feel their position with you is threatened and start to worry about their short to medium term future. At the same time your staff and suppliers are seeking their cost of living and business costs increasing, with little they can do about it.

It is at exactly these times of economic uncertainty that your staff and suppliers will start to feel increased stress about how they will meet their own financial obligations. For many it is a lifestyle issue, for others it really is a matter of survival. Committing fraud is often seen as the only way.

According to the U.S.Geological Survey (USGS), world total reserves of iron amount to about 81,000 million tonnes contained within 170,000 million tonnes of crude ore. Australia and Brazil are among the world’s largest iron ore holders and hold a large portion of the world’s iron ore reserves. As of 2013, Australia had reserves of 17,000 million tonnes of iron content and 35,000 million tonnes of crude ore while the figures for Brazil were 16,000 million tonnes and 31,000 million tonnes respectively.

Stratiqa is pleased to advise that we have opened an office in San Francisco. This extends our reach to the West Coast and beyond; with a number of clients in Asia also engaging with us via SFO.

Contact details for SFO can be found here.

We look forward to working with both new and existing clients in sunny California.

China’s economic rise has entered into an interesting phase from an historical perspective. While China is still logging 7+% growth a year, many regions in the world economy are growing 1% or less and in some cases, even contracting. As a result China needs to rebalance their economy from an export led growth model to a domestic consumption driven model. At the same time, Chinese companies flushed with cash are looking for value acquisitions in countries currently facing more acute economic challenges. China is well positioned to acquire some interesting assets and companies all over the world to compliment the needs of their domestic economy.

Evidence points to a pickup of pace for Chinese outbound M&A activity in the recent years. According to Mergermarket, overseas acquisitions from China have tripled since 2005 to a total of 177 M&A transactions in 2012, and the total value of these outbound transactions have increased nearly five-fold to US$63.1bn in 2011. In terms of sector, energy and resources continue to account for the lion’s share of transactions accounting for 70% of value and 30% of volume in 2012. Industrials and chemicals is a close second in terms of volume, accounting for 21%, however in terms of value it was dwarfed by the energy and resources sector accounting for only 11% of transaction values. Geographically, Western Europe proved very popular for Chinese buyers accounting for 29% of volume and 31% of value, mainly due to its industrials and chemical companies. North America however, was the biggest outbound market for Chinese companies in 2012 due to the abundance of energy and resources, accounting for 20% of volume but 35% of value.

From our perspective, China’s outbound M&A activity seem to be focused around three key areas: 1.) Securing access to raw materials. 2.) Acquiring industrial companies with cutting edge technology, Intellectual Property (IP), or production know-how. 3.) Consumer focused companies that have a strong brand. Often an acquisition may present an opportunity in more than one area, such as Lenovo’s acquisition of IBM’s personal computer business in 2005 as well as their recent attempt to acquire part of IBM’s server business. However many factors can complicate these cross border M&A deals, and from our experience there are a few problems that many Chinese enterprises encounter repeatedly.

Chinese Outbound M&A IssuesGovernment regulatory issues

One of the major factors that can cause problems for Chinese companies acquiring assets overseas is governmental approval and requirements, both domestic and foreign. This is especially true for large transactions or transactions in strategic industries. Typically, a Chinese domestic firm making overseas acquisitions will need approval from at least these three key ministries:

Stratiqa talks to Asian Private Equity investors. Investors remain bullish and will commit the same amount of capital or even more. The focus will be local, focusing on home markets and close neighbouring markets.

Close to 85% of Asia-Pacific Private Equity investors plan to commit the same amount or more capital in 2012, with 70% of them looking to invest locally according to data collected by Stratiqa.

“Markets are maturing in Asia, and there are emerging economies in South East Asia coming out of distress like Sri Lanka, Cambodia and Bangladesh. Investors still look for growth in Asia with stagnating growth in the West. Fundamentals are still strong in Asia, and we believe a rising consumer market with increased purchasing power makes Asia the place to be.” Stratiqa said.

Our conversations with Asian investors suggest that they are likely to stay focused investing in private equity and real estate. Many investors are strengthening their focus towards forming family conglomerates rather than the GP/LP structure. However given the rising demand of Western investors to enter Asian markets, the traditional private equity structure is still prevailing in Asia in terms of growth.

80% of the Asia based PE investors preferred investing locally, however, 2/3 indicated that China as a market is becoming very crowded and there are too few worthwhile deals. Nearly half of the investors surveyed pointed towards ASEAN for the best opportunities in the region. Malaysia, Indonesia and Thailand were the three strongest markets for potential acquisitions.